proposed federal estate tax changes 2021

Under current law the existing 10 million exemption would revert back to the 5 million exemption. The current estate tax exclusion for an individual is 117 million effectively 234 million for married couples.

Tax Flyers Tax Refund Tax Services Tax Preparation

Before December 31 2021 a client without prior gifting can transfer 11700000 without incurring a federal transfer tax and a married couple.

. The taxable estate is taxed at 40. The maximum estate tax rate would increase from 39 to 65. The September proposal accelerated this sunset to the end of 2021 so the base exemption available to taxable gifts and estates would be 5 million 62 million adjusted for inflation beginning January 1 2022.

Current Transfer Tax Laws. Thankfully under the current proposal the estate tax remains at a flat rate of 40. The current rate is an estate.

Is 117 million in 2021. The current lifetime exemption is US117 million per individual. Estate gift and GST tax exemptions will remain at 117 million with increases allowed for inflation in 2022-2025.

The proposed impact will effectively increase estate and gift tax liability significantly. For the vast majority of Americans the federal estate tax the death tax has been a non-issue since 2010 when the exemption was raised to 5 million and indexed for inflation. As of January 1 2021 an individual may give up to 11700000 during life or at death without incurring any federal gift or estate tax.

Under the current proposal the estate. Additionally these proposed tax rates would apply to taxable estates worth up to 1 billion. The current US117 million exemption from the generation-skipping transfer tax on gifts or bequests to.

Bernie Sanders introduced an 18-page bill called the For the 995 Percent Act. The Biden Administration has proposed significant changes to the income tax system. Proposals to decrease lifetime gifting allowance to as low as 1000000.

If enacted into law the new estate and gift tax exemptions and rates would apply to estates of decedents dying and gifts made after 31 December 2021. The federal gift estate and generation-skipping transfer GST tax exemptions that is the amount an individual can transfer free of any of these taxes are 117. The Biden Administration has proposed sweeping estate tax impacts to the estate and gift structure.

Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. The bill would reduce the current federal estate and gift tax exemptions of 117 million per person to 35 million for transfers at death and 1 million for lifetime gifts. Recent Changes in the Estate and Gift Tax Provisions Updated October 19 2021.

Under the proposed legislation the federal estate tax exemption which is the amount of ones estate that can pass free from tax at death would be sharply reduced. Decreased Estate Tax Exclusion. The exemption applies to total bequests and gifts separate from the annual inter-.

The Sanders bill would affect multigenerational planning with trusts as well. The federal estate tax would apply at death to individual estates with assets in excess of US35 million. Reduce the current 117 million federal ESTATE tax exemption to 35 million.

President Biden has proposed major changes to the Federal tax laws some of which are sought to be effective earlier in 2021 ie we are already operating under these changes if they later become adopted as compared to the effective date the new tax law changes may be passed by Congress or a later effective date such as beginning January 1. Lifetime estate and gift tax exemptions reduced and decoupled. However the revised proposals have eliminated this early sunset so if enacted the higher exemption would remain available through.

Estate and Gift Tax Exemptions The Biden framework does not include lowering the current estate gift and generation skipping transfer GST tax exemptions before the previously scheduled sunset date of December 31 2025. Here is what we know thats proposed. The current 2021 gift and estate tax exemption is 117 million for each US.

Read on for five of the most significant proposed changes. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022. That is only four years away and Congress could still.

The Biden campaign is proposing to reduce the estate tax exemption to 3500000 per person 7000000 per married couple. Reduction in Federal Estate and Gift Tax Exemption Amounts. However under the legislative proposals.

In addition the proposed bill provides that estates or trusts with income over 100000 would be subject to an additional 3 tax on their modified adjusted gross income. If a decedent dies in 2026 with an estate of 11700000 the exemption amount would. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation.

The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed for inflation prior to the scheduled sunset on January 1 2026. The tax reform proposals announced by the Administration in April and the General Explanations of the Administrations Fiscal Year 2022 Revenue Proposals. Starting January 1 2026 the exemption will return to 549 million adjusted for inflation.

2 CRS Report 95 -416 The Federal Estate Gift and Generation Skipping Transfer Taxes by Emily M. With inflation this may land somewhere around 6 million. So a family could end up paying both a transfer tax and then an estate tax and with the exclusion set to return to a level somewhere around 6 or 7 million many farms would be subject to both.

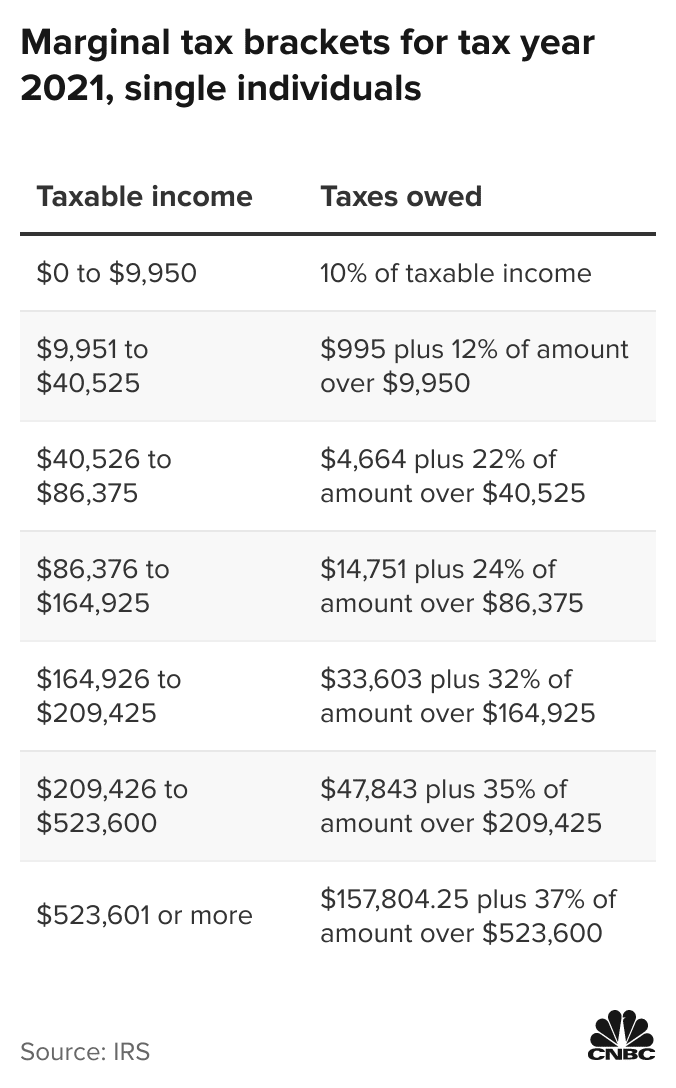

The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. Capital gains tax would be increased from 20 to 396 for all income over 1000000. The changes would be effective beginning after December 31 2021.

The exemption is the. It includes federal estate tax rate increases to 45 for estates over 35 million with further.

Here S How Rising Inflation May Affect Your 2021 Tax Bill

It May Be Time To Start Worrying About The Estate Tax The New York Times

Estate Tax Exemption 2021 Amount Goes Up Union Bank

Tax Increase Talk Prompts Wealthy To Splurge On Muni Bonds Bond Funds Corporate Bonds How To Raise Money

Do I Need To Pay Taxes After Retirement Liberty Tax Service Sales Jobs Life Insurance Beneficiary Tax Services

2018 Real Estate Tax Reform Guide The Bateman Group Estate Tax Online Real Estate Getting Into Real Estate

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

What Are The Capital Gains Tax Rates For 2020 And 2021 Financial Stocks Stock Market Capital Gains Tax

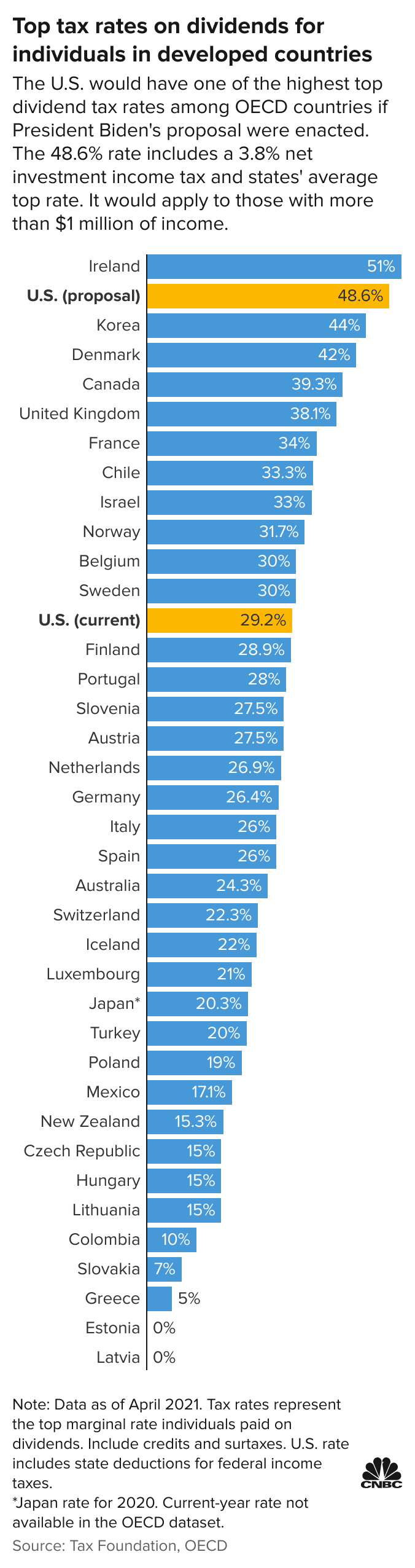

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Market Update Success Rate Mentor Coach Marketing

New Estate And Gift Tax Laws For 2022 Youtube

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

2021 Salary Guide Pay Forecasts For Marketing Advertising And Pr Positions Salary Guide Positivity Advertising

How To Plan Around Estate Tax Uncertainties Charles Schwab Estate Tax Capital Gains Tax Tax

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

How To Make A Year End Planning Checklist Ellevest Financial Coach Wealth Planning Planning Checklist